As usual with Bordeaux En Primeur, the campaign dragged itself out for nearly six weeks – starting with Carruades de Lafite on the 12th May and finishing with Vieux Chateau Certan on the 20th June.

The picture that emerged before the campaign begun was of a small, heterogenous vintage, with what are likely to be substantial peaks and troughs in quality from appellation to appellation and estate to estate. (Heterogenous in this instance meaning that the quality of wines and speed of growth are not consistent across the whole region, or even across each sub appellation actually. Hence, peaks and troughs comments above)

A challenging vintage, such as 2021 does not however mean poor wines. This is especially true of a region such as Bordeaux, where investment in winemaking equipment and extremely sophisticated levels of viticultural knowledge and expertise has greatly softened the bumps that come with awkward growing seasons.

It is important to mention that yields were down 30-50% across the region for the 2021 vintage – and so the consequent reduction in supply could strengthen the investment value in the coming years.

As you will see below with many of the wines that we purchased in the campaign – there is a reason why the best wines are the best year on year.

They have the best plots, the best situation, they have incredible fire power to purchase the most expensive tech and machinery so they can ensure they are making the very best wines. Therefore we are very happy with the purchases made and we were quite impressed with the majority of samples tasted earlier in the year when we visited Bordeaux for Primeur week.

Release Prices

Before the releases in each campaign, members of our WIW team head to Bordeaux to try the release wines – and whilst down there, there is plenty of conversation between growers, negotiants and other merchants from all over the world about compariable vintages and expected releases prices.

Once back in the UK, we undertake a process where we calculate an acceptable bandwidth for expected release prices – and if they fall within those parimeters, then we are comfortable that it is a sensible purchase for the syndicates.

Fortunately almost every wine that we targeted sat at the bottom end of the purchase price bandwidth, accordingly we are cautiously optimistic for another good investment campaign.

The 2021 Investment Wines purchased

As you will see, we have continued to only purchase the top wines that have a very long track record of being sold in the secondary market. Many of the wines below will be allocated to your portfolio.

- Angelus, Saint Emilion

- D’Armailhac, Pauillac

- Ausone, Saint Emilion

- Berliquet, Saint Emilion

- Beychevelle, Saint Julien

- Branaire Ducru, Saint Julien

- Brane Cantenac, Margaux

- Calon Segur, Saint Estephe

- Canon, Saint Emilion

- Carmes Haut Brion, Pessac Leognan

- Carruades de Lafite, Pauillac

- Cheval Blanc, Saint Emilion

- Cos D’Estournel, Saint Estephe

- Ducru Beaucaillou, Saint Julien

- Duhart Milon, Pauillac

- Figeac, Saint Emilion

- Giscours, Margaux

- Haut Brion, Pessac Leognan

- La Conseillante, Pomerol

- Lafite Rothschild, Pauillac

- Langoa Barton, Saint Julien

- Leoville Barton, Saint Julien

- Leoville Las Cases, Saint Julien

- Lynch Bages, Pauillac

- Margaux, Margaux

- Montrose, Saint Estephe

- Mouton Rothschild, Pauillac

- Palmer, Margaux

- Pavie, Saint Emilion

- Pavillon Rouge, Margaux

- Petit Mouton, Pauillac

- Pichon Lalande, Pauillac

- Pontet Canet, Pauillac

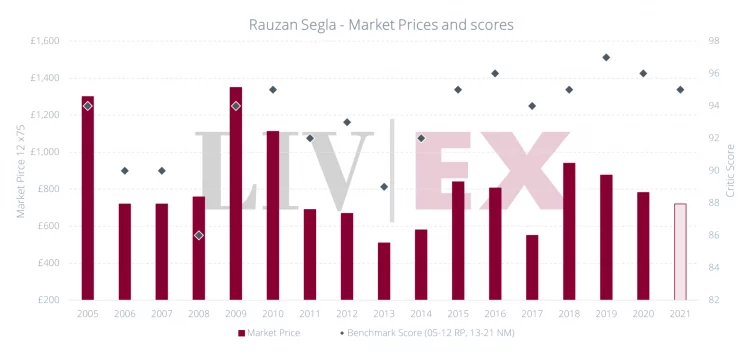

- Rauzan Segla, Margaux

- Troplong Mondot, Saint Emilion

- Vieux Chateau Certan, Pomerol

These wines will start to be allocated into syndicates next week using our normal balanced criteria. Once we have finished this process we will confirm the purchases for each syndicate and update the web portal accordingly to review at the beginning of August.