2023: Market Report

Economic Overview

The year 2023 has proven to be challenging not only for the fine wine market but also for global financial markets and consumers. The IMF’s projections indicate a slowing world economic growth trajectory, impacted by the lingering effects of the pandemic, the Russian invasion of Ukraine, and conflicts in Israel and Palestine. While inflation is gradually receding from the peaks of 2022, core inflation remains high, leading to multiple interest rate hikes globally.

In the UK, the Consumer Prices Index (CPI) showed a 4.6% rise in the 12 months to October 2023, reflecting a decrease from previous months. However, energy prices, though lower than their peaks, still contribute to the overall higher cost of living.

On a global scale, emerging and developing economies demonstrate more resilience, except for China, where economic growth forecasts for 2023 have been lowered to 5%, primarily due to challenges in the real estate sector.

The overall economic landscape translates into reduced consumer spending power, increased costs, and a slow recovery, likely peaking in 2024. This has a direct impact on the fine wine market, with buyers becoming more cautious and unwilling to spend as much as in previous years.

Fine Wine Market

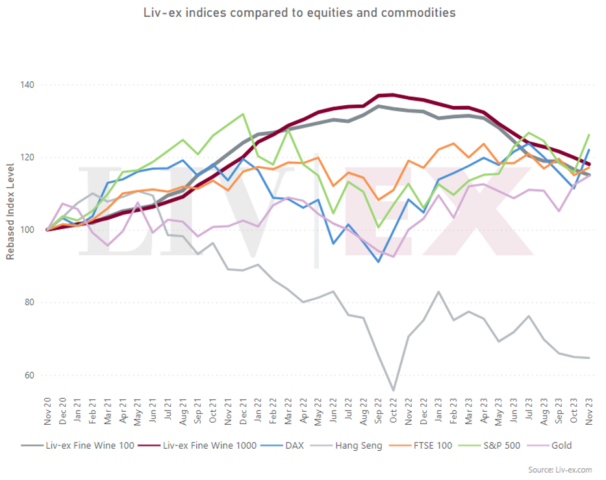

The fine wine market in 2023 faced continued challenges, contrasting sharply with the two halves of 2022, where rapid growth in the first half gave way to a downturn. Major Liv-ex indices, including the Fine Wine 100, Fine Wine 50, and Fine Wine 1000*, retraced most of the gains from the previous two years, with declines ranging from 13.0% to 13.4% year-to-date.

Comparing 2022, when fine wine outperformed other financial indices, to 2023, a shift is evident. Equities markets like the S&P 500 and gold have rebounded, while fine wine indices exhibit less buoyancy but remain at comparable levels.

Despite a unique En Primeur 2022 campaign where release prices were considerably higher than previous years, Bordeaux remains a safe haven for collectors. In contrast, Burgundy’s share declines due to increased risk aversion, impacting prices and trade numbers for newer, less-established brands.

The overall assessment by The Knight Frank Luxury Investment Index paints a more optimistic picture of the market and its trends in the past year. It indicates that challenges in the luxury market were primarily influenced by the underperformance of Burgundy and the substantial impact of high inflation. These factors might influence the pricing strategy for next year’s releases, with producers potentially needing to offer discounts to encourage consumers to opt for their products instead of holding cash.

While wearable investments like watches and jewelry showed satisfactory performance, the luxury market exhibited mixed results. Notably, whisky, often compared to wine, faced a decline despite its strong performance over the last decade.

Overview

In the current fine wine market downturn, there’s a noticeable shift toward safer assets like older Bordeaux vintages, reflecting a broader trend favouring quality and established brands. However, brands that surged in 2021/2022, like Domaine Arnoux-Lachaux and Château Lafite, are now seeing significant declines.

Anticipations of upcoming high-yielding vintages raise concerns about the market’s capacity for expensive wines. Campaigns like Burgundy and Bordeaux En Primeur in 2024 become crucial, requiring strategic pricing. The fine wine market is in a familiar standoff observed in bear markets, where buyers resist current prices, sellers hesitate to lower them, and accumulating stock poses challenges. Until there’s an improvement in the macroeconomic landscape and a decline in interest rates, finding a compromise between buyers and sellers remains essential.

The Market Going Forwards

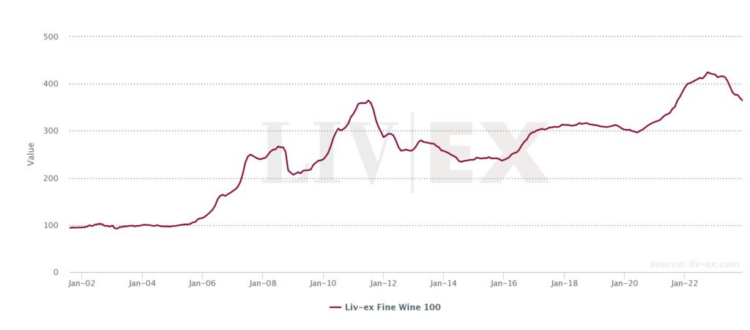

Whilst nobody possesses a crystal ball, gaining insights into the future often involves reflecting on the past. Drawing parallels with history, the closest economic analogy to our current situation lies in the 2008/09 financial crisis. Although the circumstances differ, the end result mirrors an economic downturn. During that period, the price of wine dipped as consumer demand for fine wine waned—an inevitable consequence of basic supply and demand dynamics.

For present-day investors, there’s solace in the fact that the market experienced a highly profitable period from 2009 to 2011. However, the current ongoing price correction has yet to reignite buyer interest, indicating that prices may continue to face downward pressure in the short term. The suspense now hinges on whether the market will rebound in 2024, echoing the recovery witnessed in 2009.

All statistical information is from Liv-Ex

What are the Liv-Ex Indices?

- The Liv-Ex Fine Wine 100 index is the industry leading benchmark. It represents the price movement of 100 of the most sought-after fine wines.

- The Liv-Ex Fine Wine 1000 is the broadest index. It represents the price movement of 1000 of the most sought-after fine wines.

- The Liv-ex Fine Wine 50 Index tracks the price movements of the Bordeaux First Growths. It includes the ten most recent vintages of Lafite Rothschild, Margaux, Mouton Rothschild, Haut Brion and Latour.

By Edward Stevens