Q1 Investment Report: Market Shows Signs of Resilience

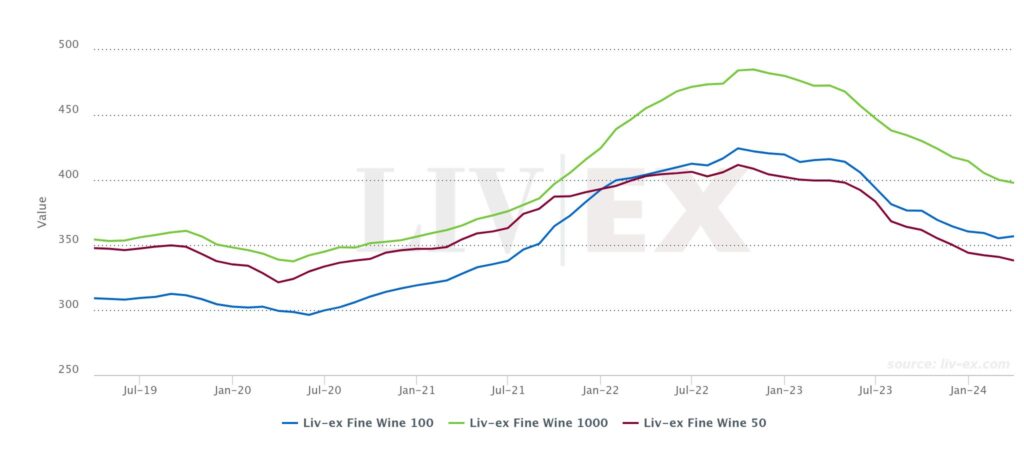

Some much needed positive news for wine enthusiasts and investors alike, the Liv-ex Fine Wine 100 index rose by 0.4% in March, marking its first positive movement since March 2023. This uptick signals a potential reversal of the downward trend that has plagued the market over the past year.

While the broader Liv-ex Fine Wine 1000 index experienced a slight decline of 0.6%, it was a significantly milder drop compared to the previous month, hinting at a potential stabilisation of prices.

Despite some fluctuations, individual wines showcased notable resilience. Among the top performers were two Napa Valley wines, Promontory 2018 and Dominus 2019, both experiencing substantial price increases. Additionally, wines like Sassicaia from various vintages continued to demonstrate strong performance, underscoring enduring demand for quality labels.

The positive momentum extended beyond price movements. March witnessed an increase in exposure on the Liv-ex exchange, indicating growing interest and activity within the market. While there was a slight decrease in the number of brands and individual wines traded compared to February, the uptick in exposure suggests renewed confidence among traders and collectors.

It’s not just about prices and trading volumes; the wine market’s resilience is also reflected in the stories behind the bottles. Iconic producers like Paul Jaboulet Aine and Chateau Rayas saw impressive price rises, showcasing the enduring allure of timeless classics.

Despite challenges such as the Champagne 50 index experiencing a notable decline driven by big brands trading below release prices, the overall narrative suggests a market poised for recovery. Even amidst declines over the past year, the long-term trajectory of Liv-ex indices remains a testament to the enduring value and appeal of fine wines.