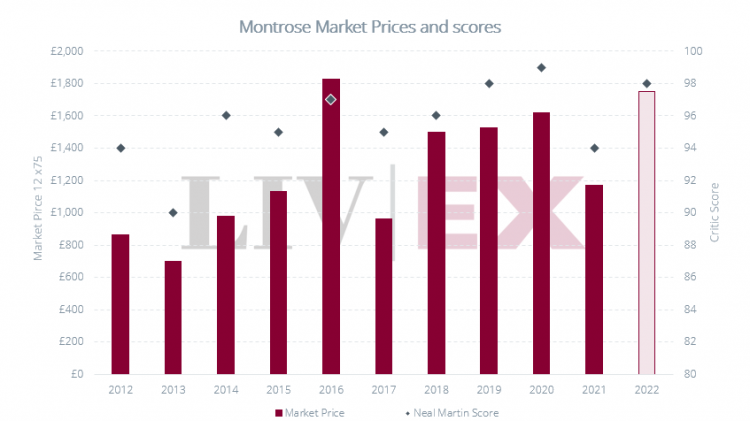

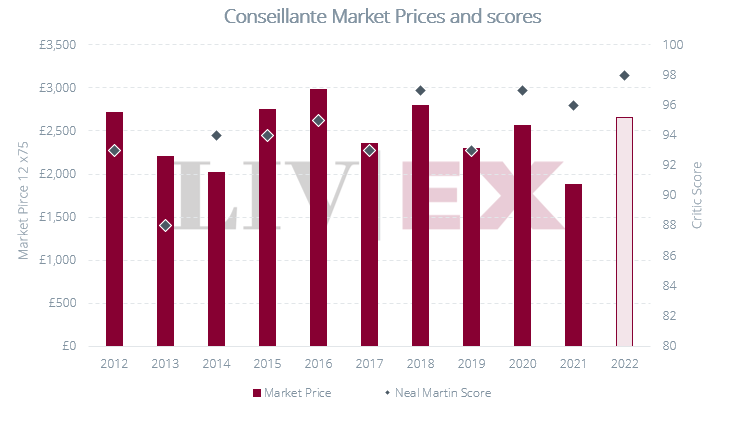

A big release from Pomerol today in the form of Château La Conseillante. It is being offered by the international trade for £2,652 per 12×75, up 40.8% on the 2021’s opening price (£1,884 per 12×75). Although the 40.8% price increase is a lot, this wine still offers fantastic value compared to previous (lower scored) vintages of this wine on the secondary market. This is a testament to how it performs as an investment year on year. We have taken our full allocation here.

Neal Martin (Vinous) gave the wine a barrel score of 97-99 points. He mentions in his tasting note that ‘Marielle Cazaux has crafted one of the most intellectual La Conseillante wines in recent years’.

William Kelley (Wine Advocate) awarded the wine a barrel range of 97-100 points. He said that ‘the 2022 La Conseillante is a remarkable wine that has the potential to emerge as one of the wines of the vintage’. He went on to say ‘congratulations to winemaker Marielle Cazaux, consulting oenologist Thomas Duclos, the Nicolas family led by Jean-Valmy, and all the team at La Conseillante who have firmly established this estate at the very top of Pomerol’s qualitative hierarchy in recent vintages’.

James Suckling agreed that ‘this is sensational’ and commented on its ‘silky, silky, silky. Creamy texture’. He awarded it 98-99 points.

If you are interested in discussing your investment wine options – please follow this link and fill in the form