Overview

A Capital Gains Tax-Free Investment Opportunity

Fine Wine is a fun and exciting investment option particularly if you have an interest in the subject. Importantly, investment wine is one of the rare asset classes that is not subject to Capital Gains Tax on the growth in value.

Wine investment is nothing new and has been going on for centuries. In the past, the English invariably bought more fine wine than they were able to consume and often sold off surplus wines for a profit. As the world became richer, the fine wine market changed considerably. During the 1990s increased demand, particularly from parts of the Far East, increased prices and demand to unprecedented levels and as a result, the fine wine market has grown considerably.

In the past, fine wine has not been affected by stock market fluctuations and generally shows less volatility tending to flatten out in times of recession. Moreover, fine wine is normally the last to fall and the first to recover as was witnessed during the global recession of 2008 and 2009. We have seen that investing in fine wine can deliver annual returns of between 10% and 12%.

What is En Primeur?

En Primeur is also known as Wine Futures. It is the process of buying wines before they are bottled (ie. still in barrel) and released onto the market. These En Primeur wines are purchased exclusive of Duty and VAT and then usually shipped 2-3 years after the vintage release.

The opening En Primeur release price is almost always cheaper than the future price of the wine on the open market. For wines that work on small allocations, En Primeur can sometimes be the only way to get your hands on limited production wines.

Investing through Waud Investment Wines

Buying investment wine should be interesting, exciting and most importantly financially rewarding. In 2015, Waud Investment Wines Limited was formed as a business upon the sound foundations of the Waud Wine Club.

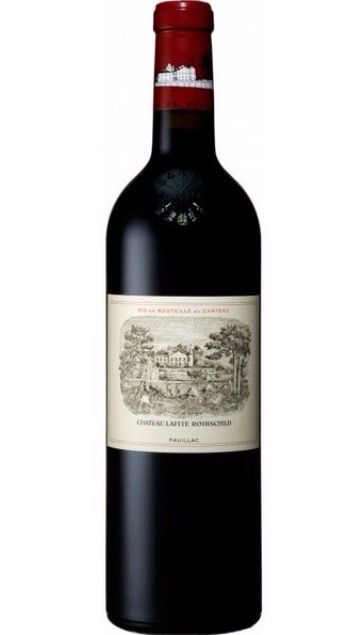

Each year we take part in Bordeaux En Primeur campaigns where we buy wines from blue-chip chateaux like Lafite Rothschild, Mouton Rothschild, Chateau Margaux, Rauzan Segla, Canon, Lynch Bages, Pontet Canet, Chateau Palmer and Chateau Angelus. We also run campaigns with other high end investment grade wines from around the world including Opus One in California, Sassicaia and Masseto from Italy, as well as Seña from Chile.

The strategy is simple. Buy wines with perfect provenance, with critical acclaim, released at the right price, that we are confident will give our customers a positive return in the mid to long term.

From the time you invest, your wine will be allocated to you, typically when the wine is in barrel. We will ship your wine to the UK and land them directly into your dedicated account at our bonded warehouse.

It is important for you to understand how your wines are managed, so follow this link to read about Wine Storage, Insurance, Management fees and other services that are linked to your investment.

The wine industry is not regulated by the Financial Conduct Authority (FCA) – and therefore it is important to understand that we are not giving financial advice. Like all other investment classes, values can go up and down.

Your wine however is a tangible asset, that only improves with age, so the very worst case scenario is that if your wine does not increase in value as much as you wish, you will be able to enjoy drinking your fine wines for many years to come!