This article depicts some of our own views, top and tailed with a few extracts from Liv-ex article: Bordeaux 2021: Another chance to energise the market.

We are coming off the back of another great trilogy of Bordeaux vintages with 2018, 2019 and 2020 all up there as very good or excellent vintages. With 2021 deemed as a challenging vintage for most, there is then plenty of potential for 2021 to be a very interesting investment opportunity.

The headline news of the 2021 vintage is as follows:

- A cool climate vintage – that has a larger than normal drinking window (can be enjoyed early, with an ability to age well)

- Wines produced are precise, well balanced, low alcohol with good freshness

- Volumes are down – somewhere between 20-30%

- It is a heterogenous vintage – some chateaux produced very good wines, others not so

- An opportunity for Chateaux to release with attractive pricing to re-energise the market.

2021 Vintage summary

A difficult and heterogenous vintage does not automatically equate to universally poor wines. This is especially true of a region such as Bordeaux, where investment in winemaking equipment and extremely sophisticated levels of viticultural knowledge and expertise has greatly softened the bumps that come with awkward growing seasons.

Looked at through a glass half full and on the basis of available data, one might say that the best wines will offer 2014 and the better-end-of-2017 levels of quality, with coolness and leafy freshness, that are good for early drinking.

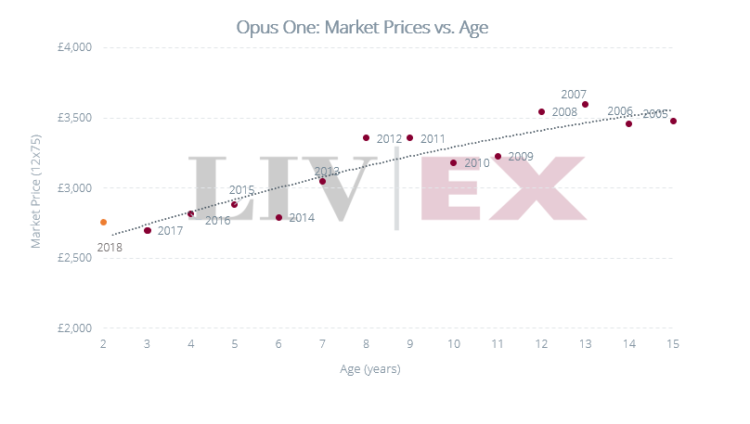

From our seven Bordeaux campaigns, 2014 is up there with 2019 as the most successful vintage in regards to return on investment. If the Bordelaise decide to release at a sensible pricing for the 2021 campaign, this will encourage buyers to pile into Bordeaux Primeur and the 2021 campaign will once again provide an interesting vintage and interesting investment opportunity.

As you will see with many of the wines that we purchase – there is a reason why the best wines are the best year on year. They have the best plots, the best situation, they have incredible fire power to purchase the most expensive tech and machinery so they can ensure they are making the very best wines. These wines include Lafite Rothschild, Mouton Rothschild, Ch Canon, Rauzan Segla, Pontet Canet, Leoville Barton, Ch Margaux, Ch Palmer, Cheval Blanc, Angelus, Figeac and many more.

We will continue to take our full allocation of these, subject to sensible and expected release pricing – and with such low volumes available, it should be another interesting investment opportunity.

With frost savaging the 2022 vintage already, 2021 could be another important vintage for the Bordelaise to price correctly.