The 2017 campaign is finally starting to gather some pace. Following two fantastic days in Bordeaux at the beginning of this month, it was pleasing to taste some very good wines indeed.

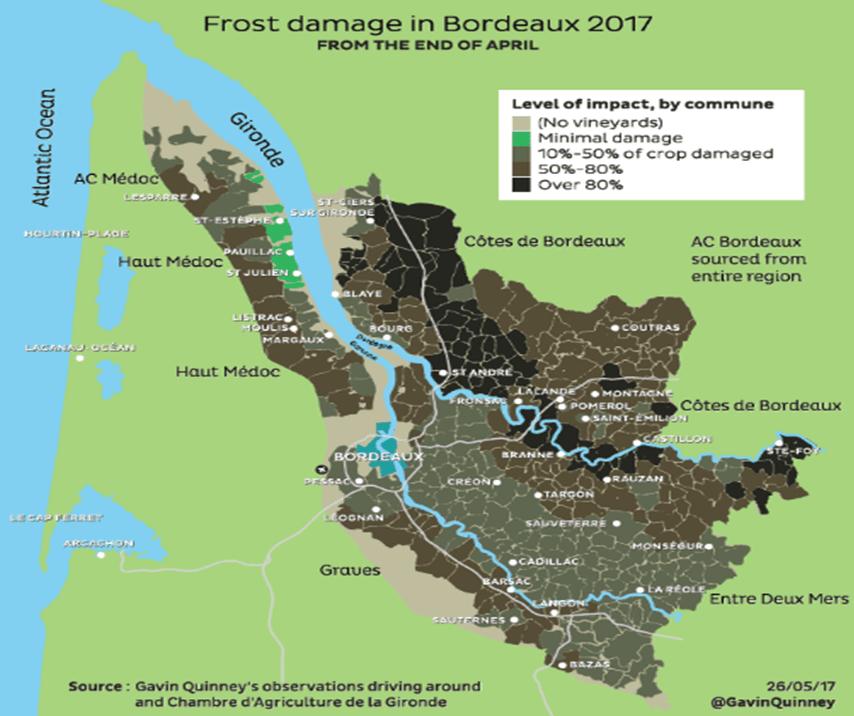

Before we arrived, much had been reported about Bordeaux being hit hard by the frost and that this would have a major effect on the quality of the wines, as well as the release prices. In fact, for the premier Chateaux where we concentrate our purchasing, this really was not the case as it showed that the top vineyards with the best terroir were hardly touched at all by the frost.

(Gavin Quinney’s diagram below shows that St Julien, St Estephe and Pauillac on the left bank had minimal damage – as well as Pomerol and Saint Emilion on the right bank having between 10%-50% of crop damaged)

What quality level are the 2017 wines?

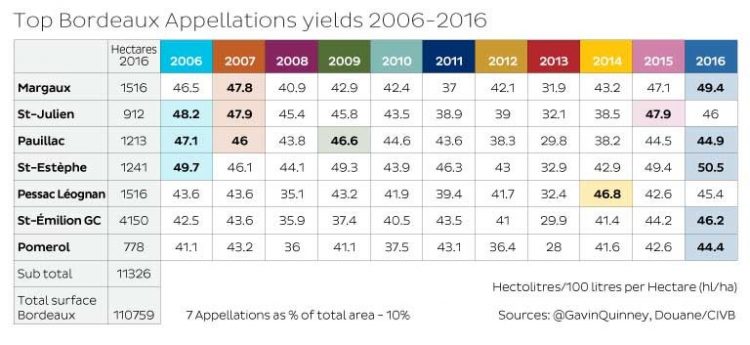

Following 2015 and 2016 that were deemed by critics across the board as ‘Exceptional’ vintages, 2017 will be referred to as ‘Classic’. 2017 was being compared to the 2014 vintage – and once Jeremy and I had been to taste the 2017 wines, we both agreed that 2017 wines offer more structure, fruit and richness than the 2014 wines – indeed, closer to the style to the highly acclaimed 2015 wines.

Highlights from our recent EP tastings in Bordeaux

During two very full days tasting with our partner négociants, we sampled just shy of 100 wines that fit into our investment wine purchase criteria. The stand out wines for us were; From the left bank – Chateau Margaux (notably including their extraordinary pure Sauvignon Blanc which they make just 12,000 bottles of – Pavillon Blanc), Cos d’Estournel, Pichon Longueville (Comtesse de Lalande), Lafite, Mouton Rothschild, Leoville Barton and Chateau Beycheville.

One of our favourites, Pontet Canet in Pauillac currently displays a lovely palate but is rather closed on the nose and it is hard to determine the potential at the moment – whilst we will have a good allocation and it will probably turn out very well, the pricing will determine our level of appetite this year, but indications are that we will invest much more modestly with the 2017 vintage.

We also had a fantastic tasting and were very taken with the wines of Ducru Beaucaillou in Saint Julien – a wine we have not considered for investment before. Chateau Palmer in the next-door property to Margaux has many people in the trade excited and this wine has just released at 20% below 2016 prices and is being rated by some at as high as 97 points. For us, whilst very good, it was a little obvious and didn’t quite have the delicacy and finesse of its neighbour!

From the right bank, we were again impressed by Chateau Canon and Clos L’Eglise.

How do we think the campaign is going to pan out?

As with every Bordeaux EP campaign, it comes down to the quality of the wines and then the release prices. There was much discussion when we were in Bordeaux around the 2017 pricing expectations, and in conclusion, consensus was that prices should come somewhere between 2014 and 2015 release prices. If this turns out to be the case, we are in for a very exciting campaign as predicted.

Today (Mon 23th Apr) was the first proper day of the campaign and pleasingly Chateau Palmer, hailed as one of James Suckling’s wines of the vintage, released their 2017 wine below the price of their 2015 vintage as noted above. Hopefully this sets the tone for the other Chateaux.

Our Investment and purchasing strategy for the 2017 wines

We continue to only purchase wines for our clients that we expect to offer good returns. Even when a wine is considered fantastic at 98 points for example, if the release price is higher than for their 2016 wine, we are unlikely to buy for our syndicates, and we will direct our funds where we feel better investment value is to be found.

Our intention is to provide our investors with a sound investment return over five years – at which point they can hold, sell or start to drink the wines as they wish – a nice problem to have for these great wines from Bordeaux!

Investing with Waud Investment Wines for 2017 campaign

If you are interested in investing in the 2017 campaign, or would like more information, please contact charles@waudinvestmentwines.com