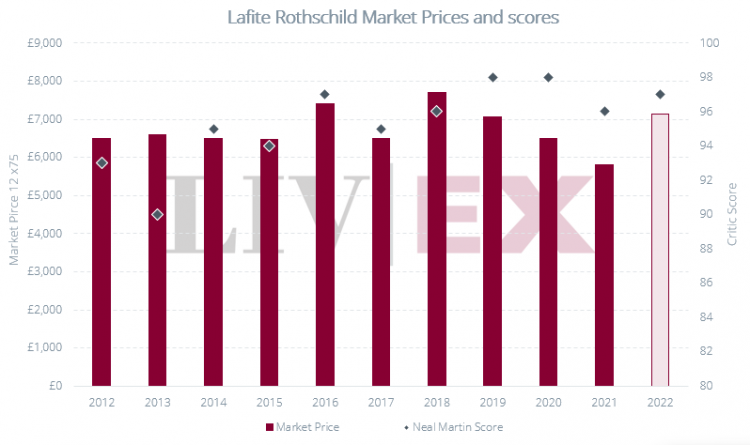

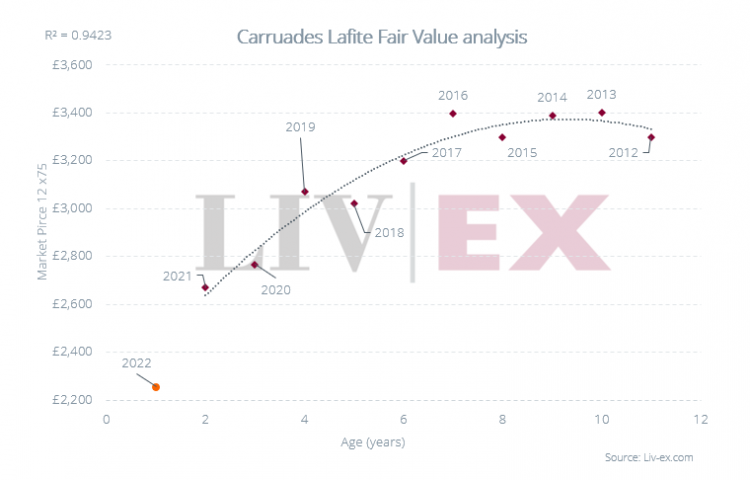

The first of the four first growths was released this morning in the shape of Château Lafite Rothschild 2022. It is being offered by the international trade for £7,140 per 12×75, a 23.1% increase on the 2021’s opening price (£5,800 a case). Even with the increase in price on 2021 (as has been the norm for the 2022 vintage), the price still compares favourably with 2018 and 2016. This is one of those wines that performs well year on year and we have taken are full allocation as usual.

Neal Martin (Vinous) scored the wine 96-98 points and said ‘perpetually the most deceptive of First Growth, one should not doubt its long-term potential’.

Several critics were quick to compare 2022 to Lafite’s greatest vintages. James Suckling awarded the wine a barrel range of 99-100, celebrating this vintage’s similarity to 1986 and its ‘purity and precision.’ In his words: ‘It’s really about being Lafite here.’ Similarly, Lisa Perrotti-Brown scored this vintage 98-100, calling it an ‘intellectual triumph’ that is ‘classic great Lafite.’

William Kelley (Wine Advocate) gave Lafite a barrel range of 95-97+, deeming it the ‘most tensile of the first growths this year.’

If you are interested in discussing your investment wine options – please follow this link and fill in the form

Neal Martin (Vinous) is yet to score the wine. Although his Bordeaux report and scores are due later this afternoon.

Neal Martin (Vinous) is yet to score the wine. Although his Bordeaux report and scores are due later this afternoon.