Liv-ex article – 2020 First Growths: where’s the value?

A recent article published by Liv-ex on the 14th June 2021.

What price would constitute “Fair Value” for the First Growths this campaign? Following on from Lafite’s release, could Margaux or Haut-Brion charge 10% extra or even more on their 2019 offers?

In a recent post, we highlighted the rising prices of the 2019 First Growths in the market since their release last summer and the enthusiastic response the 2020 wines have received from critics.

Using the Liv-ex Fair Value methodology, we can take current prices for back vintages up to 2019 and place 2020 releases with proposed 5%, 10% and 20% increases on the 2019 ex-négociant prices onto that chart.

Where does this forecast suggest the best landing spots are for each of the First Growths?

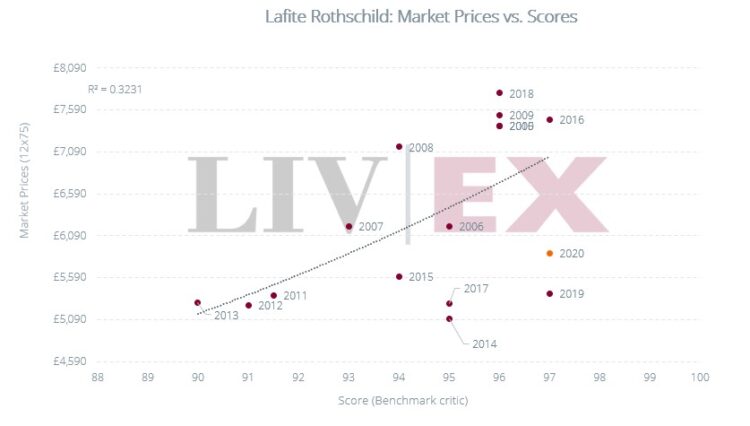

Lafite Rothschild

Many critics have commented on the quality and character of the 2020 Lafite. To begin with the vintage is a rare beast among modern Bordeaux, coming in at under 13% abv.

James Suckling commented that it was a wine that “harks back to the great wines of the 1980s and 1990s”.

Neal Martin had plenty of superlatives, saying “so Lafite it has its name tattooed onto its DNA”. It is, he continued, “not a powerful or immensely structured wine, but rather a First Growth with unerring balance and harmony, one that is unashamedly classic in style.”

The wine was ultimately released for £5,880 per case, an 8.9% increase on the 2019. This places it above the 2019 in price but still very much below the regression line, indicating Fair Value. (It should be noted that the score/price correlation is not high at just 32%)

Other back vintages that look good value at present include the 2014 and 2017. Both have 95-points (NM) and the 2014 is one of the cheapest Lafites available at £5,100 – less even than the 2013.

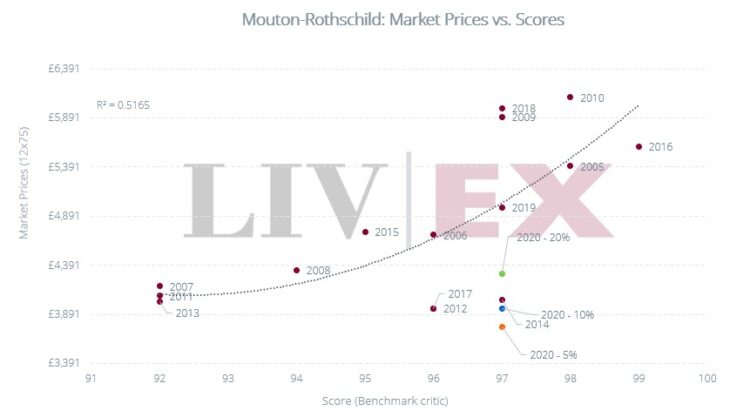

Mouton Rothschild

Mouton’s 2019 has risen the most among the First Growths, up 39% since release. This gives the estate ample opportunity to raise its price and remain Fair Value.

Above 10%, however, and the 2014 (which has the same Benchmark Critic score) will look better value.

The critics found much to admire in the 2020. “This is a marvellous Mouton,” said Martin, “as smooth as Snoop Dogg’s flow”.

“It is certainly the most coy, reticent and elegant grand vin of this trio of vintages (2018, 2019 and 2020),” added Lisa Perrotti-Brown MW, “bearing Mouton’s signature perfume, opulence and stylishness with great grace and sophistication as opposed to devil-may-care flamboyance.”

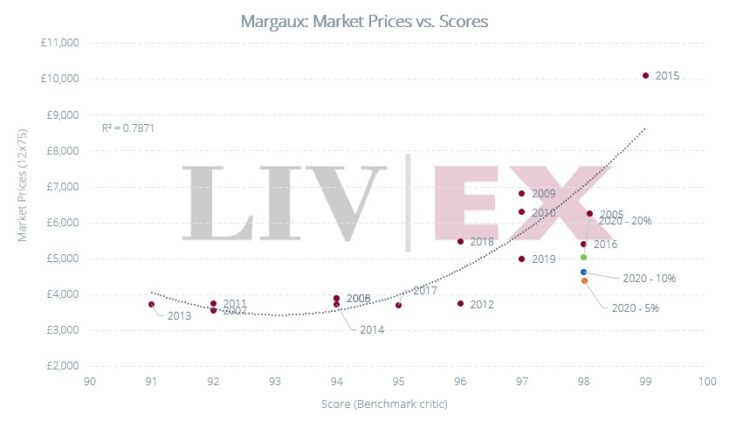

Ch Margaux

One of the highest-scored First Growths on average and also the one First Growth with the lowest variance in its scores. It is undoubtedly one of the anticipated releases of the campaign.

It was the only First Growth where Neal Martin raised his score on the 2019, with a bracket of 97-99. “Cerebral and sophisticated, and one of the wines of the Left Bank in 2020,” he said.

James Lawther MW, writing for JancisRobinson.com, likewise thought the 2020 had the edge on the 2019 and Jane Anson said it was her pick of Left Bank estates.

The 2019 has climbed in price 19% since release. This means that, with its improved score, an increase of up to 20% would render the 2020 Fair Value, and still below the current price of the similarly-rated 2016.

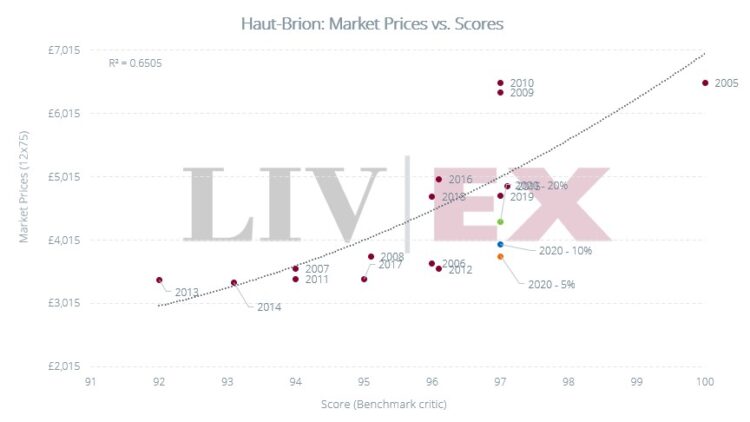

Haut Brion

Haut-Brion picked up two potential 100-point scores, from Perrotti-Brown and James Suckling. It is the highest-rated First Growth this vintage alongside Margaux.

“Simply stunning,” declared Perrotti-Brown,

Its 2019 has enjoyed the second biggest rise in price since last summer, up 23%. As with Margaux and Mouton, therefore, a rise of as much as 20% would keep the price of the 2020 below both the current price of the 2019 and the regression line.

The 96-point 2012 vintage is another physical vintage currently offering good value as well.