Fine wine proves its worth as inflation rises

A Liv-ex article published on the 18th May 2022.

The UK Consumer Price Index (CPI) hit 9% in April, the highest level in 40 years.

The CPI reflects the prices of a basket of consumer goods and services known as ‘normal goods’, such as transportation, food, and medical treatment. According to many economists, these normal goods have no potential investment value during times of inflation.

By contrast, several asset classes perform well in inflationary environments. For example, real estate, gold and other luxury goods are often popular inflation-hedging investments options.

How does inflation impact fine wine?

‘Luxury Goods’ are the opposite of necessity goods as they tend to be sensitive to a person’s income or wealth (as wealth rises so do purchases of luxury items). As inflation continues to rise, one would think that the performance of luxury goods would decline. However, as corporations strive to keep wages up-to-date with inflation, luxury goods are also seeing increased demand. For example, luxury group LVMH, just announced a 23% growth in Q1 2022 revenue.

Fine wine is a combination of investment and a luxury good. It has ‘an active secondary market’ and both inherent tangibility but also scarcity (especially over time). As such, it tends to perform well during times of uncertainty and inflation.

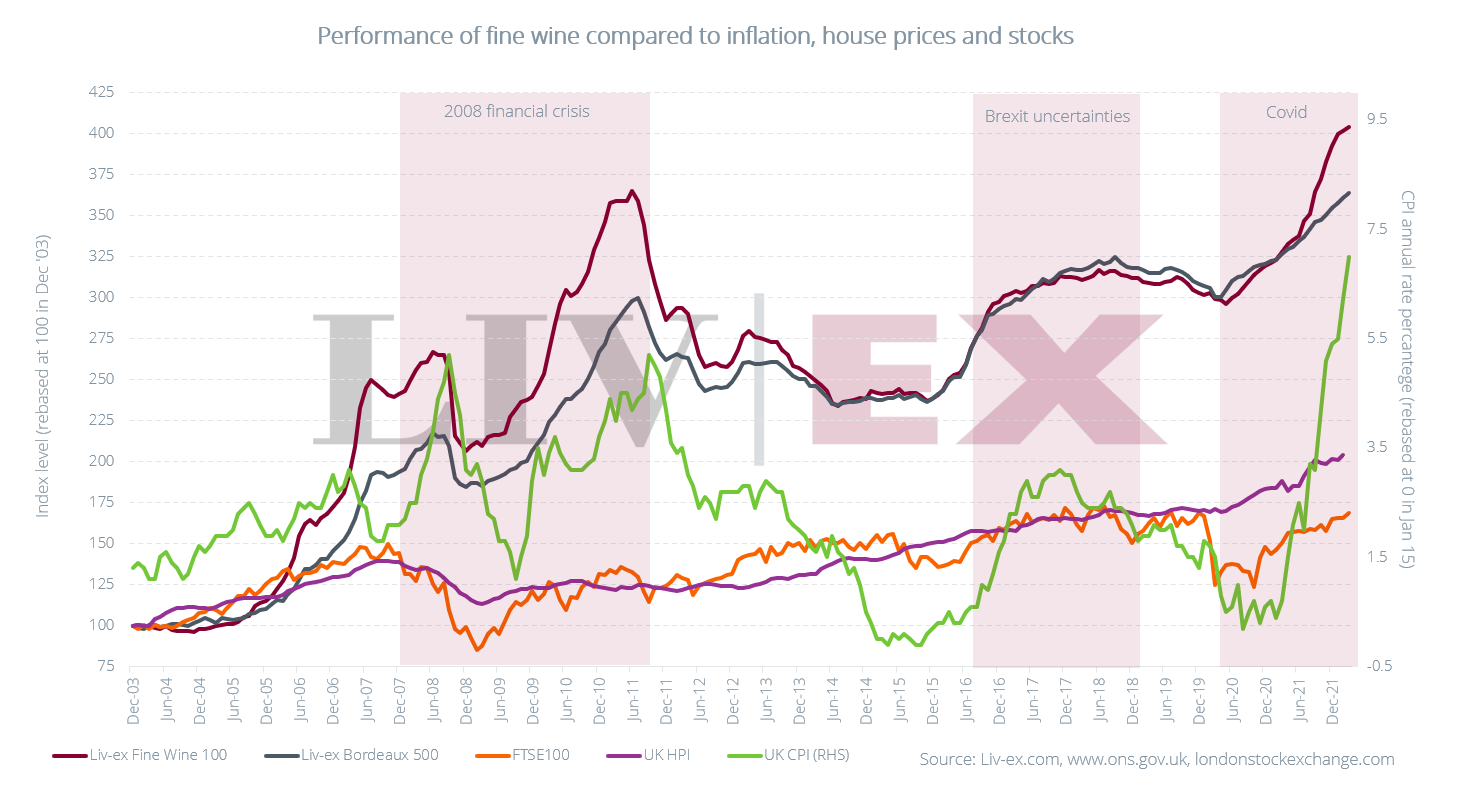

The chart below compares fine wine, stock and housing investments to the CPI. As you can see, the performance of the Bordeaux 500 and Liv-ex Fine Wine 100 indices mirrors the pattern of CPI, rather than stocks (FTSE100) or housing (HPI).

Fine wine would appear to be a wise investment for inflation protection. With inflation rising once more, collectors may be taking note.

Fine wine would appear to be a wise investment for inflation protection. With inflation rising once more, collectors may be taking note.