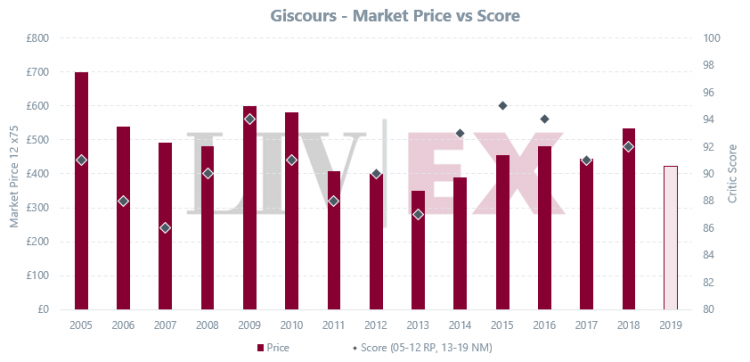

First out this morning is very popular Chateau Giscours from Margaux with their 2019 offering.

The wine is being offered at £211 per 6×75, a 22.7% decrease from the 2018 release of £273 a case.

Well supported by the critics;

96-97 Points, James Suckling – “Lots of deep blue fruit with blackberries and grape skins, as well as tar and asphalt. Lead, too. It’s full-bodied, yet very tight with powerful, defined tannins, surrounded by attractive ripe fruit. Serious. Reminds me of the excellent 1975. A blend of 65% Cabernet Sauvignon and 35% Merlot.”

94 Points, Jane Anson, Decanter – “This is a serious Giscours, with medium intensity violet-edged ruby colour. High aromatics on the nose with cumin and cloves, followed by black cherry and cassis fruits that do a good job of filling the palate, and a cooling menthol finish as the tannins close in. Enjoyable overall, succulent yet with precision. Harvest lasted for an entire month, from September 11 to October 12, the longest ever at the estate and a reflection of more precise plot-by-plot work, with vines separated according to age and terroir. Thomas Duclos is consultant here as of the 2019 vintage. A yield of 44hl/ha.”

95-97 Points, Jeff Leve, The Wine Cellar Insider – the wine “has richness and depth, while focusing on its purity and freshness. The long finish, with its fabulous lift and sweetness in the fruit keeps on going, long after the wine has left the glass. This is the best vintage produced in the long history of Chateau Giscours”. He also revealed that this was the longest harvest in the history of the Chateau.

If you are interested in finding out more about investment wine – please contact charles@waudinvestmentwines.com

If you are interested in finding out more about investment wine – please contact charles@waudinvestmentwines.com

If you are interested in finding out more about investment wine – please contact

If you are interested in finding out more about investment wine – please contact

If you are interested in finding out more about investment wine – please contact

If you are interested in finding out more about investment wine – please contact