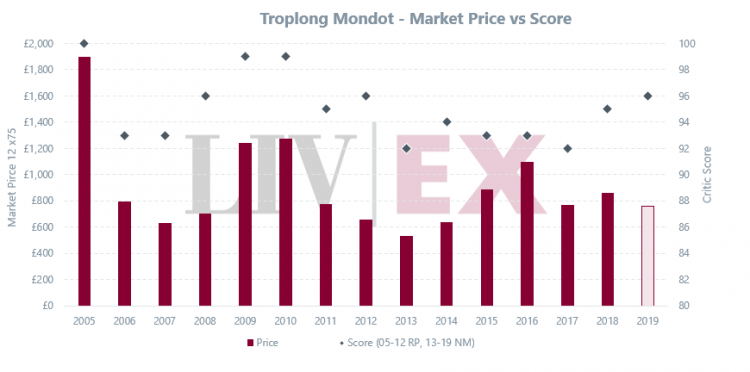

Troplong Mondot 2019 has been released at £762 per 12×75, a decrease of 17% in sterling terms on the 2018 release of £918 per case.

Troplong Mondot is a Premier Grand Cru Classé from Saint-Emilion – and we believe one of the great buys of the campaign.

Neal Martin, 95-97 points. “It is a wonderful Saint-Émilion from Aymeric de Gironde and his team, more approachable than the 2018, to be frank, just a wine you are going to want to drink”.

Antonio Galloni, 96-98 points. “The 2019 Troplong Mondot is sensational. Rich, vibrant and explosive, the 2019 pulses with energy”.

Lisa Perrotti-Brown MW, 96-98 points. “The pH is 3.55—pretty incredible when you consider the alcohol is nearly 15%! I hasten to add that from tasting, I would have guessed this was 14.3% to 14.5% alcohol. It is the kind of wine with so much energy it practically does pirouettes on your palate.” With this ABV, the wine is also exempt from the 25% US tariffs.

If you are interested in finding out more about investment wine – please contact charles@waudinvestmentwines.com

If you are interested in finding out more about investment wine – please contact charles@waudinvestmentwines.com

If you are interested in finding out more about investment wine – please contact

If you are interested in finding out more about investment wine – please contact